February 12th, 2024

Jackson Bubala

Account to Account (A2A) payments, those made directly between two bank accounts using payment networks like the Automated Clearing House (ACH) and Real-Time Payments (RTP), account for tens of billions of dollars in transactions each year. These kinds of payments accounted $525B in global eCommerce volume and 6% of U.S. eCommerce transactions in 2022 and, and McKinsey believes A2A consumer payments could surpass $200B in the U.S. by 2027.

Today, domestic A2A payments volume is concentrated in peer-to-peer payments (P2P) platforms like Cash App and Venmo, but has struggled to capture market share in other types of payments like business-to-business (B2B) and consumer-to-business (C2B). The success of PIX (Brazil) and UPI (India), combined with the launch of real-time payment rails in the U.S. (RTP, FedNow), has motivated startups to try and buck this trend. The majority of recent innovations in A2A payments target retail payments in particular – both in store and online commerce transactions between consumers and business (merchants).

Most people I’ve met who are working in this space take A2A adoption in retail as a forgone conclusion. I disagree, at least in the U.S. A2A offers several benefits for both merchants and consumers, but I don’t think it’s a compelling alternative to credit cards (which dominate retail payments), and am skeptical that A2A will ever steal significant market share from card payments in U.S. retail.

By the same token, it shouldn’t surprise you that I’m not convinced A2A payments for retail are a good venture investment, either. Some would argue that A2A adoption is growing in eCommerce and they’d be right according to FIS research, but eCommerce represents just 15% of retail sales volumes. Still a large market, sure, but can startups here ever reach the payments volume required to be fruitful investments or beat the payments incumbents to A2A?

This post is not a comprehensive analysis of A2A payments or its alternatives, nor a definitive declaration that A2A payments are doomed. Instead, this post is an attempt to acknowledge the potential benefits of A2A payments and flesh out my take that A2A payments are poised to struggle in retail. I’m open to changing my mind and I’d love to hear your feedback.

Benefits of A2A Payments

A2A payments aren’t all bad. In fact, A2A promises improvements to existing payment methods and there are several reasons why merchants and consumers might benefit from using it instead of credit cards.

Lower Fees

A2A transactions cost merchants about $0.40-50 cents per transaction compared to card transactions which typically cost 2-3.5% of the transaction value. With potential savings of up to 70% per transaction, it’s no surprise merchants are interested in this payment method. Lower transaction fees would also theoretically flow through to consumers, though it’s unclear if merchants are willing to do this and how much discount they’ll need to offer to encourage consumer adoption of A2A.

Faster Settlement

A2A payments today primarily leverage the ACH payment rail. This takes several days to move money, only marginally better than the card rails. Newer payment rails, though, like Same-day ACH (2016), Real-Time Payments (2017), and FedNow (2023) can move money instantly (for the most part). As a result, merchants can access revenue much sooner. Refunds also move faster as a result of these upgrades, meaning consumers benefit, too. Instead of taking up to 10 days to receive a refund, consumers can access funds nearly instantly. These are obvious improvements to the card rails, but come with trade-offs in fraud protection. For example, real-time payments are by and large irreversible, which means when money is sent via real-time payment rails it can’t be clawed back in the event of a dispute.

Higher Security

A2A payments benefit from bank-grade authentication (users sign-in using bank account credentials) which could reduce fraud and chargeback losses for merchants. Merchants are also relieved of the duty of storing customer card information with this payment method. A2A should be “safer” for both consumers and merchants, but it’s unclear yet to what extent it will reduce fraud and ultimately losses for merchants.

So, A2A payments can be cheaper, faster, and potentially safer than card payments, benefiting both merchants and consumers. Sounds like a no brainer, but I don’t buy it.

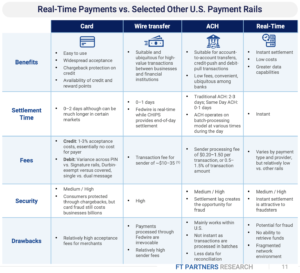

Before I explain why, here’s an excellent overview of domestic payment rails from FT Partners which compares existing payment rails, including the ACH and real-time payments rails used in A2A payments:

Why A2A Won’t Catch on in Retail

Credit Cards: The 800-pound Gorilla

Credit card spend surpassed $13T globally in 2022 and transaction volume continues to increase for both in-store and online commerce according to FIS. Despite the higher fees, lower security, and slower settlement, card volume was nearly 25 times greater than A2A volume in 2022.

Card payments have a particularly strong foothold in retail for a few reasons:

Familiarity and Ease of Use

Consumers are used to swiping a card or tapping their phone’s digital wallet to make a payment. According to MX, 78% of consumers prefer to pay for things with familiar payment methods and credit cards fit this bill. Further, the infrastructure required to accept credit cards is ubiquitous among merchants, so card payments are convenient and familiar to merchants, too.

Rewards

Consumers can earn generous discounts, cash back, or points as a reward for using credit cards to transact. Rewards are very popular with consumers and serve as a strong incentive to use cards, even if they are worth more in sentiment than in actual value (typically 1 point is equal to 1 cent).

Float

Credit cards provide a free, 30 day credit line to consumers for every purchase. Even if consumers don’t think of credit cards in this way, “free financing” is one of the strongest incentives to use cards.

Fraud Protection

The card networks (Visa, Mastercard, Amex) provide fraud protection for the merchants who accept their cards and the consumers who use them to transact. The cost of this service is baked into the network fees charged to merchants and it’s highly effective in preventing fraud. For example, global credit card fraud reached $32.4B in 2021 according to Merchant Cost Consulting, which, compared to the $13T in credit card spend in 2022, is just 0.24% of total spend – strong performance if you ask me.

Why A2A Won’t Steal Significant Volume from Credit Cards

My hypothesis is pretty straightforward: The credit card system is really good and unlikely to be replaced by A2A payments in U.S. retail. Consumers like paying with credit cards because it’s familiar, credit card rails are effective, and the incentives for using credit cards are compelling.

Behavior change is hard. Exacerbating this issue is the fact that A2A payments command lower interchange fees than credit card payments. Credit cards generate 2-3.5% per transaction in interchange fees and the banks who issue credit cards (issuing banks) give part of this fee revenue back to the consumer in the form of rewards (points, cash back, discounts). This encourages more card usage. A2A payments, on the other hand, generate just $0.40-50 cents per transaction which makes for a much smaller pie from which to reward consumers and means merchants will need to take responsibility for encouraging usage (rewarding consumers) by discounting their products, eating into their revenue. This model puts extra pressure on small dollar transactions, further shrinking the pool of retail transactions suitable for A2A payments.

An A2A enthusiast might say “well, sure, A2A payments don’t generate as much interchange fees as credit card payments, but lower interchange fees means consumers will save money.” This is a logical conclusion, but there is evidence which shows that lower interchange fees don’t result in lower costs for consumers.

Lastly, as we covered earlier, real-time payments come with serious trade-offs in fraud protection due to their irreversible nature. Banks have been slow to adopt these payment rails as a result which is sure to slow merchant and consumer adoption of these payment rails, too,

Card-based payments are an entrenched consumer behavior, merchants are deeply familiar with how they work, and consumers like rewards. That will be very difficult to replace.

Where does A2A Make Sense?

It should be clear by now that I don’t think retail commerce is the right answer. But, I do think A2A is a compelling alternative for other types of transactions, like those dominated by checks and cash.

Checks and cash payments are inconvenient, slow, lack reward systems, and lack many security measures. They are much higher friction than credit cards or digital payment methods like A2A, but remain popular methods of payment nonetheless.

Take, for example, buying a car. Almost 30% of cars are paid for in cash according to CDK Global; checks are not uncommon. In the event a cashier’s check is used to purchase a car, the consumer must first be approved to purchase the vehicle, leave the dealership to get the check at their bank (assuming this happens during banking hours), then go back to the dealership to pay for the car. The dealership then waits several days, hoping the check is not fraudulent, for the check to clear and receive funds in their account.

Pretty inefficient, huh? And the passenger vehicle market in the U.S. alone is expected to reach $555B in 2024… a pretty massive market without the entrenched consumer behavior of using credit cards!

A2A provides several improvements to check and cash payments, and I think it’s a much more compelling alternative to these payment methods than to credit card payments.

We see evidence of this today in rent payments. Though many consumers still pay by check, many landlords offer digital payment options, typically credit card or… pay by bank aka A2A. Landlords typically pass on the credit card fees to consumers, so A2A is a popular choice for rent payments. I don’t think many A2A payments offerings in rental payments leverage real-time payments networks, but A2A seems like a clearly better option than checks for consumers and landlords alike.

Finally, A2A may be a strong contender to take over B2B payments. There’s probably enough here to write about in a separate post, which I might do, so I’ll leave it at this for now (I originally intended for this post to be 500 words and I’m already at 1500, so…).

So Why the A2A Buzz in Retail?

I don’t have an answer for this. What do you think? What am I missing?

Do merchants have enough influence over consumers to drive A2A adoption? Are merchants willing to discount their products in order to drive adoption? And by how much? Are consumers willing to adopt a new payment method? A recent PYMNTS.com survey suggests they might be, with 36% of respondents having used A2A payments in the months leading up to the survey and 40% being open to adopting A2A payments if incentivized to do so, but the survey data reveals that “P2P payments account for the bulk of all A2A transactions,” so not the retail adoption some were hoping for.

It’s worth noting that one variable which could turn this argument on its head is regulation. Its impact on the card network’s pole position in retail commerce payments is TBD for now, but we’ve already seen congress push back on card network fee hikes and lobby for increased competition between card networks in an effort to lower costs for consumers and appease merchants.

At the moment, I don’t see why A2A payments will beat card payments in retail commerce.

Maybe it doesn’t have to?

————————

Special thanks to Matt Miller, Dan Eidell, Kyle Perez, Pete Chiccino, and the Motivate team for the many conversations which inspired this post and editing several drafts.

————————

Sources & Additional Reading

- MX – What Influences Where Consumers Chose to Bank

- FIS – The Global Payments Report 2023

- FIS – Instant Payments Poised for Growth in the U.S.

- CFPB Proposes Rule to Jumpstart Competition and Accelerate Shift to Open Banking

- Plaid – The Future of Account to Account Payments

- McKinsey – The Role of US Open Banking in Catalyzing the Adoption of A2A Payments

- CDK – Who’s Paying Cash for Cars?

- Dick Durbin – Statement on Card Network Swipe Fees

- Dick Durbin – Bipartisan Credit Card Competition Act

- Merchant Cost Consulting – Credit Card Fraud Statistics 2024

- Statista – Passenger Cars – United States

- PYMNTS – The Digital Payments Takeover

- U.S. Census – Quarterly Retail E-Commerce Sales

- FT Partners – The Fintech Journey Continues