Portfolio Company Spotlight Series: March 2024 MESH

To kick off 2024, Motivate Venture Capital is introducing its Founder Spotlight Series to highlight our exceptional founders who are changing the face of industries through technology. Our Founder Spotlight series starts with Bam Azizi, CEO and Co-Founder of Mesh

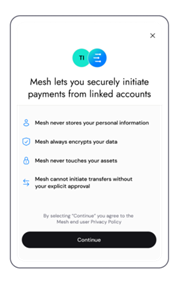

Mesh is a modern financial operating system that provides enterprise clients with the ability to enable digital asset transfers, crypto payments, account aggregation and trading, all within their platform. Need to move assets seamlessly between fintech apps, wallets and bank accounts? Mesh can help. Leveraging integrations with 300+ partners, Mesh is creating an embedded financial ecosystem that is more open, connected, and secure for businesses and users alike.

Last year, Mesh raised a $30MM Series A funding round led by Money Forward, with participation from Galaxy, Samsung Next, and others. The company recently announced an additional strategic investment from PayPal Ventures. The investment was made almost entirely using PayPal USD (PYUSD), PayPal’s U.S. dollar-denominated stablecoin, and was transferred on-chain using the Mesh API.

Before founding Mesh in 2020, Bam co-founded and was the CTO of NoPassword where he and his team developed 2,000 integrations to bring frictionless authentication to financial institutions before being acquired by LogMeIn in 2019. Working on NoPassword was his introduction to the financial services industry, as he is a computer scientist by trade, earning his PhD from the Technical University of Munich.

MVC: What was the original version of Mesh and what were your inspirations for starting the company?

Bam Azizi: Originally, Mesh was a B2C company called Front. We enabled consumers to execute trades and manage investments across all their brokerage accounts in a single app. Initially, we started building backend infrastructure for the B2C application that was very similar to what we had built at NoPassword. Even though it looks very trivial, it took us 10 years to learn how to build secure integrations in a scalable way. We are glad a lot of companies found value in what we were offering.

MVC: Despite your success with the consumer business, you decided to pivot to a B2B model. Can you walk me through that decision and transition?

BA: Lots of companies have transitioned from B2C to B2B, such as Plaid and Yodlee. In our case, our DNA and core were API integrations to build secure authentication to enable seamless account aggregation and transfers across asset classes. Our B2C application was successful because other founders who were relying on Plaid could not do what we were doing. But the problem was monetization. Raising venture capital dollars for a B2C company in 2022 was very different than in 2021. There was a strong focus on revenue and profitability. It was very hard to monetize a B2C company in 2022. So we decided to double down on what we were good at, which was B2B SaaS and API integrations. We launched on Product Hunt to validate our value hypothesis. That week, we ranked #3 on Product Hunt and landed five early-stage fintech customers. We built on that momentum and three months later we pivoted completely to B2B. It was a very organic and natural pivot for us.

This also led to a rebrand with our name. The reason we originally were called Front was because we were the front application sitting on top of a user’s brokerage account. When we pivoted to a backend solution, we were focused on API-level integrations and core integrations – anything but the “front.” We felt that we needed a new name to align with this evolved mission to build an open, connected and secure financial ecosystem. The name Mesh comes from the sense of connectivity that we provide through a modern connection layer offering read, write and transfer access.

MVC: You’ve been able to scale very quickly as a B2B company. What do you attribute this success to, and how do you think about GTM and customer acquisition?

BA: We started with a barbell strategy, focusing on both fintech startups and enterprise companies. We knew from day one that enterprise companies had really long sales cycles and when you are focused on enterprise, it might take 12-24 months to get any meaningful revenue. Like most startups, we didn’t have the luxury to wait that long to get traction, so we decided to also target smaller companies, and startups that could move and make decisions quicker. This also allowed us to test our technology with smaller-scale customers early on. On the startup side, we onboarded more than 50 customers over the course of 6 months. We launched an accelerator program giving API credits to startups with the mindset that if one of them became the next Venmo or PayPal, their success would offset the cost of all the free credits given to other companies in the program. While we were building momentum on the startup side, we started seeing some traction with enterprises. Once we felt confident that we were in a good place to focus on enterprise contracts, we doubled down on our GTM efforts there. Ultimately, enterprise is where the volume is. That doesn’t mean that we aren’t still supporting startups, but growing our roster of startups isn’t as much of a focus area for us in 2024.

Right now our enterprise focus is on brokerage, centralized exchange, and DeFi wallet companies. We want to work with tech-forward companies. Eventually, we want to expand to banks, financial institutions, and insurance companies, but that is still a couple of years away for us.

MVC: It seems like you have a very deep personal and professional network, and related to that, you’ve had a lot of success hiring impressive people to come work with you. Can you share some insights into how you approach building and scaling teams?

BA: Part of it is experience. I have interviewed maybe over 5,000 people throughout my career so I have truly seen it all. I’m a technical founder and I’ve been an engineer, so I know how to communicate with developers and coders in a way that resonates with them. There are people on my team that have worked with me for over 10 years and I think that speaks a lot to my management style. I know developers like to work in an environment where they have freedom. I delegate a lot to my team members. I am not a micromanager and I don’t believe in having several layers of management. Anyone on my team can talk to me so I think that has contributed to my success in retaining incredible talent.

MVC: What was the biggest challenge you faced in 2023, how did you overcome it, and what did you learn from it?

BA: My main concern and challenge in 2023 was growing revenue in order to raise our Series A. It was definitely not an easy year to ask people to invest in general. My main priority was finding our first 10-20 enterprise customers to help demonstrate the potential on the enterprise side. In order to do that, I set a goal to pitch to 1,000 decision-makers at enterprise customers and sign at least 10% of them. It was a lot of pitching and it was very challenging but it paid off.

2023 was focused on building the foundation for this new business. When I look back at the start of 2023, we didn’t have a name, website, materials, or collateral. We had to build all of that from scratch. Our persistence and our ability to convert sales and build meaningful revenue helped us raise the series A and now that we have the foundation, we can build upon it.

MVC: Where does the business stand today, and why do your customers love Mesh?

BA: We built a connection layer that is very modern. It gives customers access to functionality that they didn’t have previously or couldn’t build in-house. One example is that our customers use Mesh for transfer capabilities, which unlocks new use cases like deposits, payments, and payouts. A “transactable” connection layer resonates with customers because they are able to build new features on top of our technology. This allows customers to bring in new revenue and grow faster because of Mesh. We are truly the only game in town when it comes to asset transfer, trade execution, and deposits, so it is not that hard to sell to people who are already looking for that.

MVC: What impacts do you think pending potential open banking regulation will have on the Mesh?

BA: I strongly believe that the future of finance is open, connected, and embedded. We’re building a connection layer to enable consumers to move their assets from one place to another, no matter what asset class it is or where they’re banking. Open banking is building that foundation, infrastructure and culture for a company like Mesh to deliver on. Unfortunately, the United States is late to the game with open banking regulations compared to Europe, Latin America, and Asia. However, the Consumer Financial Protection Bureau (CFPB) made a clear signal that they want to accelerate the shift to open banking in the United States. This is great news for consumers and technology companies like us. We won’t need to negotiate deals with large financial institutions; they will have to be open to new technologies and offer their APIs.

MVC: What are you most excited about and most looking forward to in 2024?

BA: Our main objective in 2024 is to have as many connected accounts as possible. To achieve that, we need to work with the top payment, exchange, and wallet companies. These companies already have a critical mass of users who they can enable to bring more assets on the platform through the Mesh API. The goal is that by the end of the year when you open any exchange or wallet, you can interact with the Mesh API and product in one way or another. If we can get that, then we can get the revenue that we need. But for us, the top KPI is the usability of the product.

MVC: Congratulations on successfully raising your Series A last year, which as you mentioned, was a historically challenging fundraising year. And even more congrats is due because you just announced another strategic round from PayPal. Can you tell us a little more about the recent PayPal raise?

BA: I am thrilled to have the backing of PayPal Ventures as we execute against our vision of becoming the connection layer for a critical mass of crypto platforms and financial service providers. PayPal has an incredible track record of moving the payments industry forward, so it is no surprise they are at the forefront of stablecoin innovation and share our vision for the future of the industry.

MVC: Any asks for the audience and readers?

BA: If you are a fintech founder working in crypto, I would love to talk to you. Also, if you are a Web3 developer or engineer and want to be a part of an interesting startup that is looking to put a dent in the universe, please consider reaching out. I will personally interview you myself!

This interview has been modified for length and clarity. To learn more, visit https://www.meshconnect.com/.