Sarna

Milestones

Founded 2021

Invested in 2021

Invested in 2021

Categories

Overview

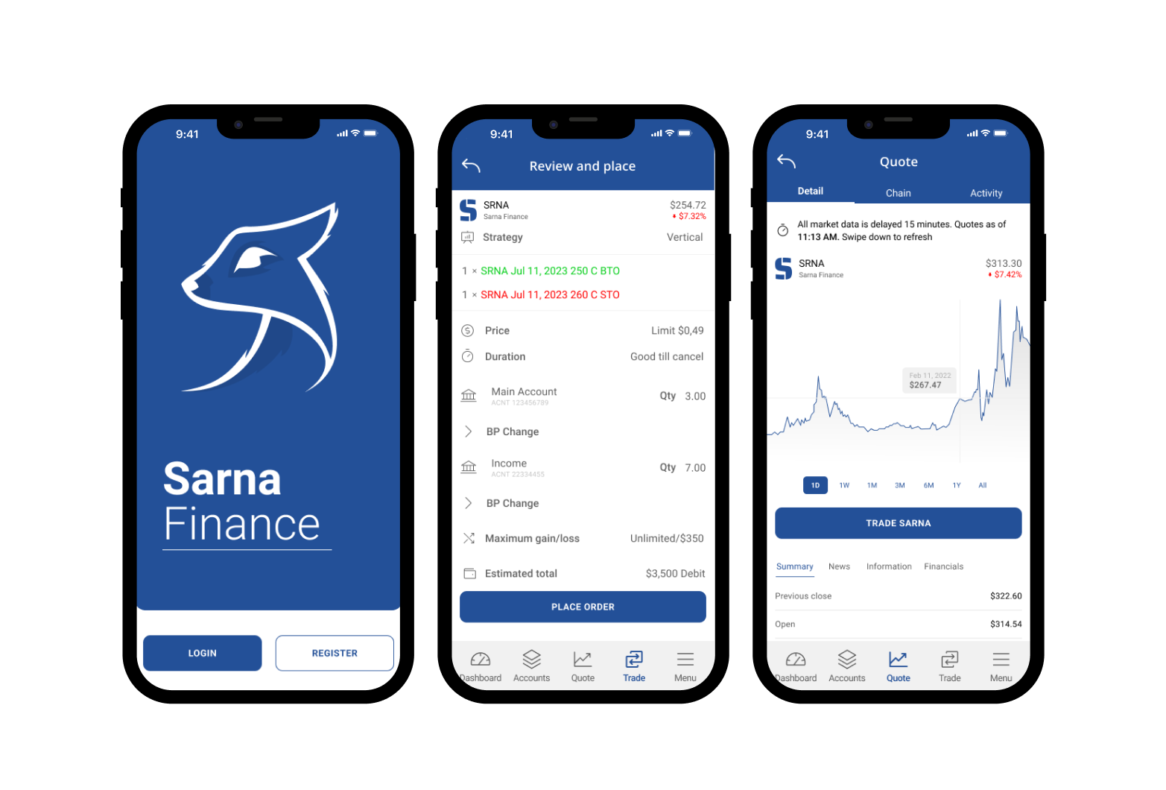

Global retail investor interest in equity options is accelerating. The OCC continues to set new annual cleared contract volume records for the U.S. exchange-listed options industry, but this surge in investor demand has taken a toll on incumbent infrastructure. In March 2020 alone, Robinhood had outages three days in a row due to stress on its infrastructure—which struggled with unprecedented load. As this trend continues, brokerage infrastructure - market data, exchange connectivity, real-time risk management, order management and routing - will continue to be strained, especially in instances where the technology stack is a patchwork of independent, legacy systems.Sarna's advanced suite of APIs provide a durable Brokerage-in-a-Box solution, including commercial-ready risk modules and real-time margin calculations for correspondent clearing firms, brokerages, and trading firms. Currently, margin calculations are often done manually or overnight, as clearing firms use end-of-day positions to calculate margin requirements for the following trading day. This leads to potential intraday position risk that Sarna can identify and help prevent with its real-time buying power engine and day-trading risk calculations. Sarna's vision is to reduce fragility in our capital markets by providing the technical infrastructure necessary for real-time settlement and clearing.

Career opportunities

Looking for a role at Sarna?

We are always considering exceptionally talented people for Motivate and our family of companies. Head to our Motivate Job Board to search open positions!